Partnership with Origin Protocol

We are delighted to announce that Origin Protocol has joined forces with DIA to launch a custom price oracle for the OUSD stablecoin as well as OETH LST.

Introducing Origin Protocol, OUSD and OETH

Origin USD (OUSD) revolutionizes DeFi interactions by offering passive yield generation directly to crypto wallets, a leap from traditional stablecoins entangled in the trade-off between spendability and earning yield. The ingenious OUSD smart contract channels capital to a variety of yield-generating strategies, ensuring yield is optimized between leading DeFi protocols. With no need to pay gas fees, earnings are auto-compounded directly in users’ wallets.

Origin Ether (OETH) mirrors much of the Origin Dollar’s codebase, with the crucial difference being its denomination in ether as opposed to USD. OETH leverages liquid staking yield, amplifying Annual Percentage Yields (APYs) through strategic DeFi initiatives and reward tokens.

Conceptualized and crafted by the adept team at Origin Protocol—comprising fintech stalwarts and a PayPal co-founder—OUSD merges the quintessential utility of stablecoins with lucrative DeFi yield prospects.

Strategic Alignment: Origin Protocol and DIA Pioneer OUSD and OETH Price Oracles

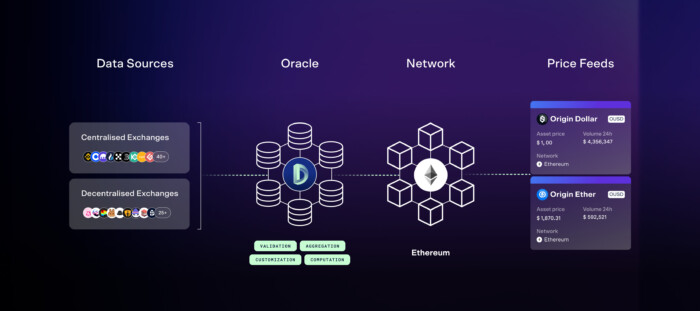

Thrilled to unveil, Origin Protocol and DIA are uniting to launch a bespoke price oracle for the OUSD stablecoin and OETH LST. This oracle, deployed on the Ethereum mainnet, proffers real-time price data for OUSD and OETH assets, synthesized from transparent trade data on exchanges, then refined and processed through transparent tailored layers.

This endeavor power the secure usage of these tokens into DeFi frameworks, broadening the tokens’ utility and enabling a plethora of applications including, but not limited to, lending and borrowing platforms, on-chain derivatives, among others.

We’re thrilled to launch our OUSD and OETH oracles with DIA. Oracles are a key piece of infrastructure that will unlock even more use cases for Origin’s tokens, being used across DeFi for a variety of applications. We’re excited to implement these oracles in lending markets and derivatives platforms, enabling more optionality for OUSD and OETH holders.Josh FraserCo-Founder of Origin Protocol

Unveiling a Multi-Source and Resilient OUSD Price Oracle

Constructed with bespoke configuration settings, this oracle stands as a robust and resilient price feed beacon. Price determination harnesses market trade data across a spectrum of Centralized Exchanges (CEXs) like Kucoin and Gate.io, and Decentralized Exchanges (DEXs) including Uniswap and Curve Finance.

Subsequently, trade data undergoes a meticulous cleansing process to weed out outliers and malicious actors, ensuring only credible trades proceed to the next phase. These trades are then organized in 120-second buckets, analyzed using a Volume Weighted Average Price with Interquartile Range (VWAPIR) methodology.

This process iteratively generates a fresh price for each asset per exchange every 120 seconds. The oracle proactively pushes the new price data on-chain whenever the asset’s price sways beyond a 2% threshold from the last reported value, ensuring accurate and timely price information at all times.