Contributing to Arbitrum’s Vibrant DeFi Ecosystem

DIA plays a key role in enabling DeFi use cases within Arbitrum’s ecosystem via the provision of transparent, customizable cross-chain price oracles for 2,500+ assets.

THE NEED FOR DIA ORACLE SERVICES ON ARBITRUM

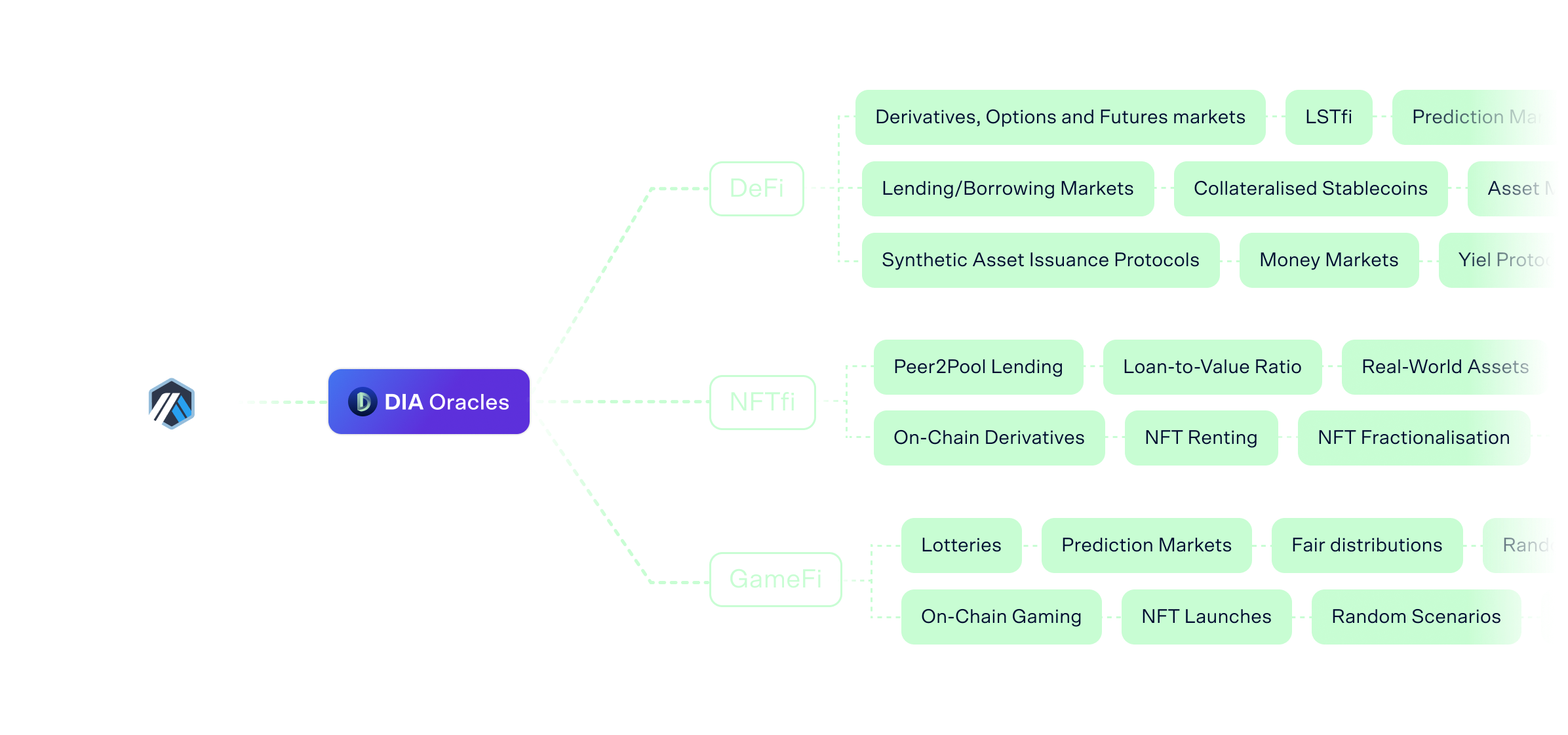

Web3 use cases enabled by DIA Oracles

DIA's FIRT-PARTY DATA APPROACH

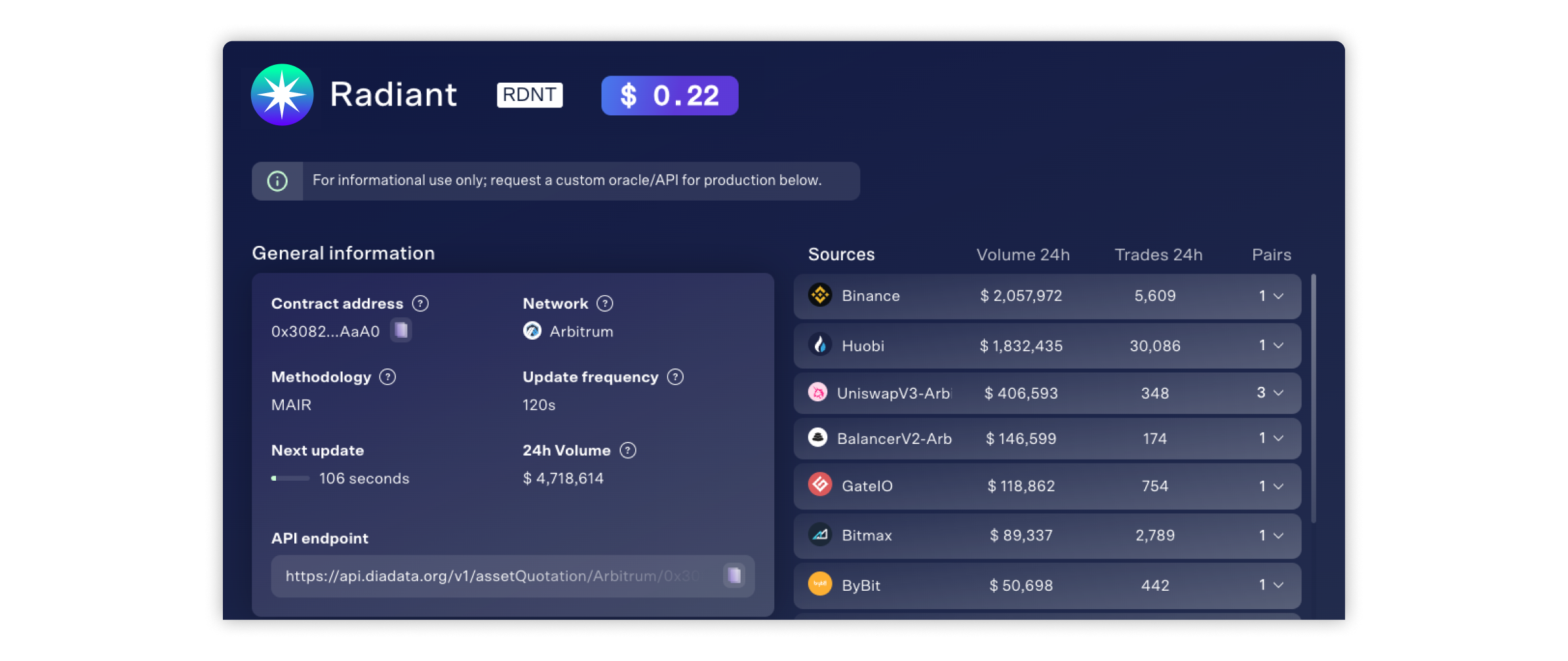

Instead of relying on opaque 3rd party data providers, DIA sources trade data directly from CEXs and DEXs, solving the issue of data opaqueness and providing Arbitrum smart contract developers and users with complete transparency about their data sources.

By tapping into a vast array of sources, including Arbitrum-native exchanges, DIA ensures unparalleled coverage of asset price data. Experience unmatched oracle price feed customizability, accuracy, and transparency.

Arbitrum Native Data Journey

“We are on a mission to deploy isolated lending markets for all crypto assets. The integration with DIA opens doors for new possibilities, starting with the JONES lending market. We’re excited about the collaboration and looking forward to many DIA-supported lending markets.”Aiham JaabariSilo Finance Growth Lead

DIA is Enriching Arbitrum's Vibrant DeFi Ecosystem

Providing High-Quality Price Oracles for Any Asset

DIA’s contributions to the DeFi sector on Arbitrum by providing high-quality price data for cryptocurrencies are characterized by the following key aspects:

Fostering Utility for Arbitrum Native Assets

Recognizing the diversity of projects operating exclusively on Arbitrum, DIA is dedicated to building price oracles for Arbitrum native assets and extending their availability across multiple chains through the provision of inter-ecosystem price feeds. This enables the listing of these tokens in DeFi protocols, enhancing their utility on Arbitrum and beyond.

To do so, DIA has developed scrapers capable of obtaining asset trade data from Arbitrum native exchanges, including DEXs like Uniswap, Sushiswap, TraderJoe, Balancer, Curve, Camelot and CEXs Binance, Kraken, KuCoin, Coinbase, etc.

These distinct features amplify the utility and usage of Arbitrum-native tokens such as GMX, RNDT GRAIL, rDPX, ARB, and many more, thereby driving innovation and supporting Arbitrum’s vibrant DeFi ecosystem.

Oracle Grants to Fuel Arbitrum Ecosystem Growth

DIA is propelling the growth of the Arbitrum ecosystem through a unique grant program designed to co-sponsor the gas costs associated with oracle updates, thereby elevating functionality and innovation across Arbitrum’s smart contract ecosystem.

Eligible projects operating on Arbitrum can apply for this grant, and the winners are chosen through a voting system. Approved projects will receive 1,000 $ARB, strictly for covering the gas costs of DIA oracles, fostering a conducive environment for dApp growth and innovation on Arbitrum.

Deploy Custom Oracles on Arbitrum, Instantly

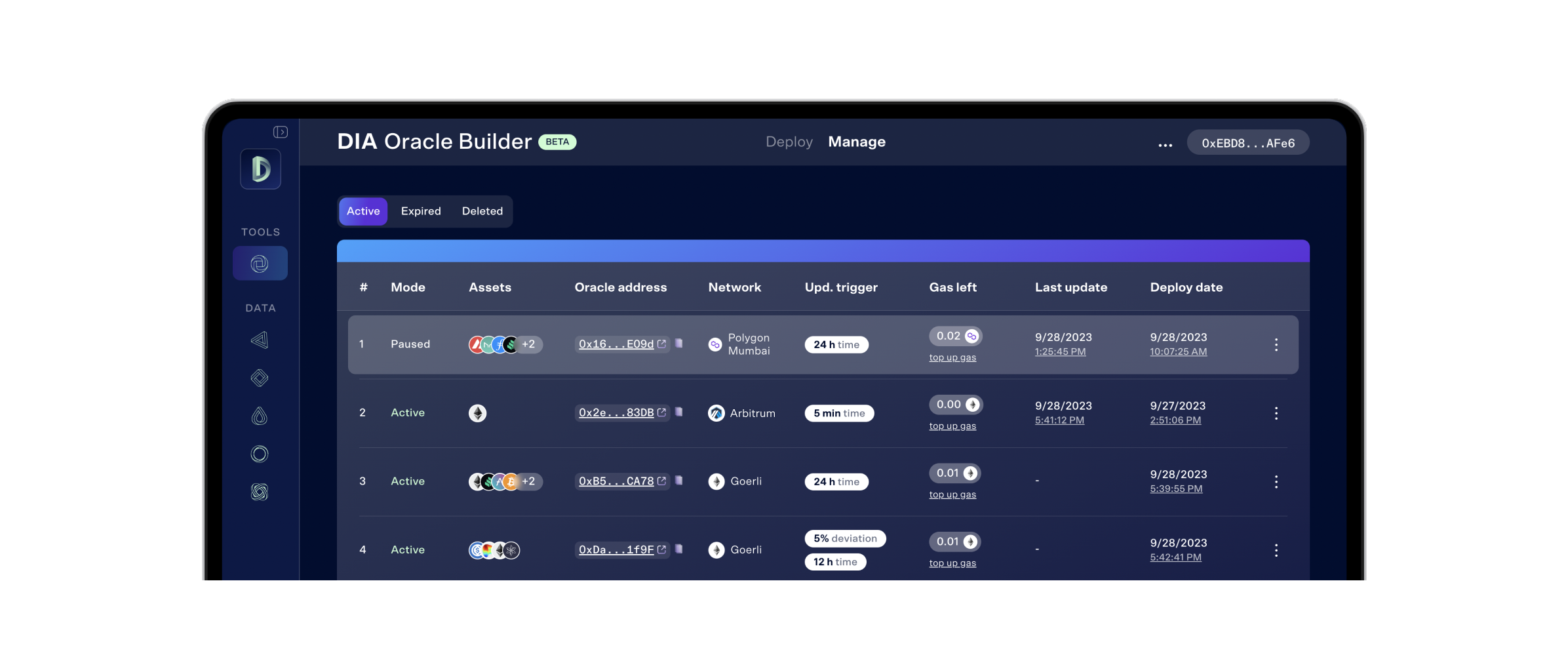

Since its release, DIA integrated the Oracle Builder specifically for the Arbitrum ecosystem, showcasing its commitment to fostering growth and innovation within the network. The Oracle Builder stands out as an indispensable tool for developers on Arbitrum, allowing for the autonomous deployment and management of custom price oracles in mere minutes.

With its intuitive no-code interface, extensive data library of over 3,000+ token price feeds, and a growing suite of features, the DIA Oracle Builder significantly enhances builders’ dApp development process, offering Arbitrum developers unparalleled flexibility and control in oracle integration.

Leading Support for Liquid Staked Tokens (LSTs)

DIA stands at the forefront of supporting LSTs, unlocking their true potential through multiple oracle pricing mechanisms. Consequently, DIA offers a comprehensive oracle solution for LSTs, ensuring robust price data for both blue-chip and long-tail Liquid Staked Tokens.

It is with utmost delight that I announce the integration of DIA oracles into the Dopex platform, which will be used to provide price feeds for our beloved token so-called “$rDPX”. DIA has been a proven and trusted partner to multiple Arbitrum protocols and we are pleased to have their support.Nutoro D. Chutoro

Dopex Core-Team

Looking to fuel the growth of your L1/L2 ecosystem?

Contact the DIA team to explore how our dedicated and custom solutions can drive innovation and bring new growth opportunities to your ecosystem.