Partnership with Rodeo Finance

Rodeo Finance Integrates a Custom DIA Oracle on the Arbitrum Network to Power its Decentralized Yield Protocol with Transparent and Customizable Price Feeds.

What is Rodeo Finance?

Rodeo is a decentralized finance protocol that allows its community to earn yield on a range of managed and passive investment strategies on Arbitrum and the greater DeFi ecosystem.

At its core, Rodeo offers Boosted Yield Farming and Structured Yield Products

Boosted Yield Farming

Rodeo has two sides: 1) liquidity providers who provide assets farmers, and 2) farmers who seek boosted yield through a variety of farms and strategies. Rodeo is introducing a novel system whereby users can stake their yield bearing assets for use in the Rodeo Farms, thus maintaining exposure to the underlying asset and earning additional yields in the farms.

Structured Yield Products

SYP allows Rodeo to innovate on top of existing DeFi infrastructure to create novel products to boost, leverage, automate and capture the best DeFi opportunities and narratives.

Rodeo’s vision is to become a Defi leverage hub for maximizing yield. Enabling users and protocols to become more capital efficient, generate higher yields, and onboard the next generation of DeFi users through a simplified, composable solution.

“Working with DIA has been a seamless process allowing us to utilize a customized, secure oracle source for our RDO token. By leveraging DIA, we are able to create additional product layers and use cases for the RDO token.”Jimbo JanglesRode Finance Co-Founder

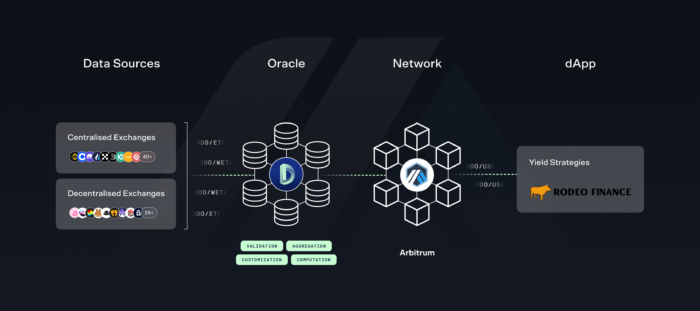

Oracle Integration: Powering Yield Strategies

Rodeo Finance has recently enhanced its platform by integrating a custom DIA oracle, a significant step in advancing its yield strategies. This bespoke oracle, specifically built for Rodeo, includes a unique price feed for the Rodeo (RDO) token. Deployed on the Arbitrum network, it sources data from various Arbitrum-native exchanges, including Camelot V3, Camelot V2, and Uniswap V3. Detailed information about these sources can be found on the DIA App’s asset detail page:

The oracle employs a 120-second trades aggregation window to collect exchange data, utilizing a Moving Average Price with Interquartile Range (MAIR) method for computing trade data from DEXs and calculating the asset’s price. To update the feed on-chain, a 0.5% deviation threshold is set, and the feed is updated every 24 hours if no deviation-based updates occur.

Benefits of DIA Oracles on Arbitrum

The integration of DIA’s oracles into Rodeo Finance’s platform on the Arbitrum network offers several key benefits. DIA’s oracles stand out for their transparency, customizability, data granularity, and accuracy. These features are particularly beneficial for the Arbitrum ecosystem, known for its extensive coverage of native exchanges.

DIA’s approach to data aggregation, directly sourcing raw trade data from over 90 sources, including both centralized and decentralized exchanges, ensures complete transparency and customization. This method addresses the issue of data opaqueness, providing Arbitrum smart contract developers and users with clear insights into their data sources.

Additionally, DIA’s commitment to supporting the Arbitrum ecosystem is evident through initiatives like the Oracle Gasdrop, which offers grants to co-sponsor the gas costs associated with oracle updates.

Look forward to adding additional yield layers for $RDO

leverage farm, lending markets and more

— Rodeo (@Rodeo_Finance) January 24, 2024