Partnership with Vector Reserve

We are thrilled to announce that Vector has designated DIA as the Go-To Oracle for its Liquid Staked Tokens vETH and svETH, fostering the Integration of the LSTs into DeFi dApps.

What is Vector Reserve?

Vector Reserve aims to leverage enhanced liquid staking and restaking yields to develop a diverse, risk-managed reserve currency based on ETH that provides top-tier yields. This is achieved by utilizing ETH, along with Liquid Staking Tokens (LST) and Liquid Restaked Tokens (LRT), to establish a varied treasury of Liquidity Position Derivatives (LPD) in conventional ETH/LST or ETH/LRT liquidity pools. These pools can then gain an additional yield increase through EigenLayer’s Superfluid Staking.

Vector Reserve Designates DIA as Go-To Oracle

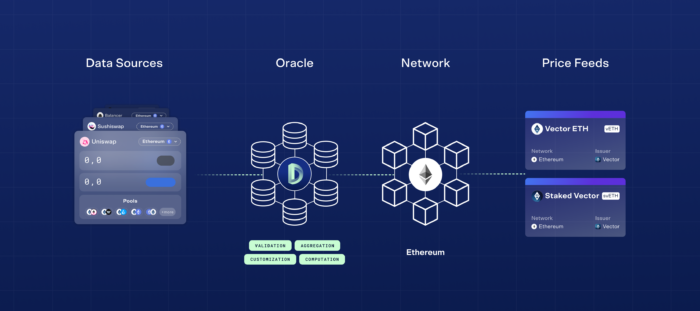

We are excited to announce that DIA, in collaboration with Vector Reserve, has built a custom price oracle to provide robust price feeds for Vector’s LSTs “vETH” and “svETH”. The oracle is set to unlock many DeFi use cases on-chain for the tokens.

We’re delighted to be using DIA oracles to support Vector Reserve’s expansion as we look to integrate vETH and svETH into a variety of DeFi platforms in order to further expand their utility. DIA oracles provide the robust, secure and cost-effective price feeds required to support a wide range of DeFi use cases. We look forward to announcing the next wave of blue chip partnerships that the DIA oracles will unlock for the Vector Reserve ecosystem.Vector Reserve team

Transparent Oracles for vETH and svETH

The oracle leverages the tokes’ trade data, fetched directly from the DEX pools where they are swapped, and applies MAIR methodology for the final price calculation. Data sources used in the calculation include pools from renowned DEXs Balancer, Uniswap, Curve, Maverick and more.

The oracle, deployed on the Ethereum mainnet with a push model, is updated with a deviation threshold of 0.5% and a heartbeat of 12 hours. This configuration provides a high refresh rate, bringing the latest price updates on-chain.

Learn more about the oracle’s configurations in the DIA Forum under the CDR #088: Vector Reserve.