Partnership with Reax Finance

We are thrilled to announce that Reax has integrated DIA’s advanced oracle technology to deliver precise, real-time pricing data for decentralized synthetic assets protocol on Telos.

What is Reax Finance?

Reax Finance is revolutionizing the DeFi landscape by offering a trustless synthetic asset issuance and trading protocol. This innovative platform allows users to trade on-chain without slippage, thanks to its unique approach of creating synthetic assets through shared debt pools.

Reax’s derivatives platform allows users to trade 500+ Real World Assets and offers a variety of DeFi products including perpetuals, synthetic options, synthetic lending, and more. Their commitment to security, decentralization, and user empowerment makes them an ideal partner for DIA.

Oracle Integration: Enhancing Synthetic Asset Creation

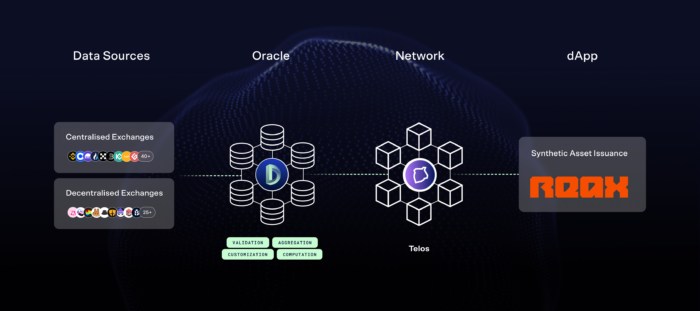

We are delighted to announce that Reax Finance has integrated a custom DIA oracle on the Telos networks to power its Decentralized Synthetics Protocol. The integration will bring real-time price information for various assets, including TLOS, BTC, WETH, USDT, and USDC. Utilizing the Moving Average Price with Interquartile Range (MAIR) methodology, the oracle will ensure accurate pricing. It will be updated whenever there’s a 0.5% price deviation, in addition to a regular 24-hour update cycle if no deviation-based updates occur.

For more information on the details of the oracle’s configuration settings, please visit CDR #076: Reax Finance

This oracle integration is crucial in synthetic asset creation, as price feed oracles provide the essential price data to mint, trade, and manage these assets securely and efficiently on-chain.

Benefits and Features of DIA Oracles

DIA oracles stand out for their unique creation process, which involves aggregating trade data directly from the sources, the CEXs and DEXs, to ensure accuracy and transparency. This aggregation includes high-volume trusted exchanges such as Binance, Kraken, Coinbase, Uniswap, Gate.io, and more.

The oracles are designed to be flexible and scalable, adapting to the dynamic needs of Reax Finance. This allows Reax to have enhanced functionalities such as full data transparency and tailored data sources, pricing methodologies, and update mechanism and frequency. This integration will facilitate seamless issuance and trading of synthetic assets on the Reax platform.

Thrilled to be powering Synthetic Assets with @DIAdata_org's cutting-edge oracles on @HelloTelos! 🤝

Their reliable, real-time data feeds are a perfect fit for accurate and secure trading on #REAX 🌊 We'll also be integrating support for DIA price feeds in our permission-less… https://t.co/0GJMXcFr4e

— REAX (@ReaxFinance) January 25, 2024