Partnership with FortiFi

FortiFi has integrated a custom DIA oracle into its advanced vault platform to support a wide array of assets, including JOE, GMX, Grail, swETH, rETH, and more.

What is FortiFi?

FortiFi is revolutionizing DeFi with its advanced vault platform, providing users with one-click access to a variety of yield-bearing strategies. Through FortiFi Vaults, users can effortlessly deposit funds into smart contracts that automate investments into custom strategies, including yield aggregators, lending protocols, and decentralized exchanges.

Price Oracles for Enhanced Strategy Execution

The accuracy of asset valuation is crucial for the automated execution of strategies within on-chain vaults. Without reliable price oracles, these vaults would struggle to perform essential operations, such as adjusting to market fluctuations in real-time or optimizing yield-generating strategies based on current asset values.

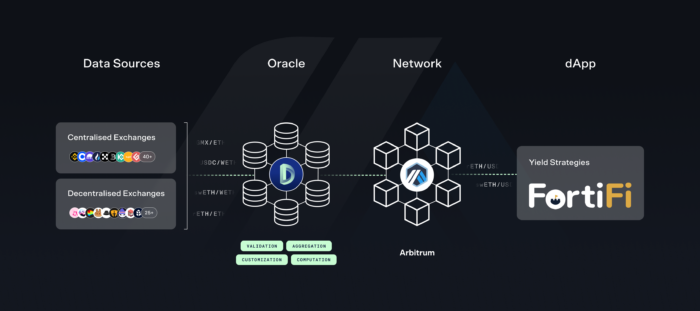

Recognizing the critical role of oracles in DeFi, FortiFi has partnered with us to integrate DIA’s oracles, ensuring the provision of precise and timely price feeds for a broad array of assets including sAVAX, JOE, GMX, PNG, Grail, swETH, wETH, rETH, USDC, USDT, and DAI. This integration is pivotal for FortiFi, enabling the platform to offer more diversified and secure investment options across two major networks: Arbitrum and Avalanche.

“We are very excited to be partnering with DIA for this integration. Integrating DIA's oracles empowers FortiFi to leverage reliable and secure price feeds for a wide range of assets across Arbitrum and Avalanche. This collaboration strengthens FortiFi's commitment to secure and transparent DeFi solutions."Alex MinerFortiFi CoFounder

A Tailored Oracle Solution for FortiFi

To meet the specific needs of FortiFi, we have deployed a customized oracle solution that delivers high-confidence price feeds through a meticulous process. Our methodology involves aggregating trade data across over 80 CEXs and DEXs, applying a 120-second trades aggregation window, and utilizing the Moving Average Price with Interquartile Range (MAIR) for calculating asset prices. This approach ensures the highest levels of accuracy and reliability, with updates provided on a 1-hour basis and a 1% price deviation threshold for triggering updates.

Learn more about the oracle’s configuration settings in the forum proposal requested by the FortiFi team: CDR #081: FortiFi | Price Feeds.