Leading Long-Tail Asset Price Oracles

In this case study, we will examine how Silo Finance benefits from integrating and utilizing DIA’s price oracles with a series of non-blue-chip tokens, enabling the launch of lending markets for these assets.

Introduction

Since 2020’s DeFi Summer, price feed oracles have emerged as a cornerstone for expanding the blockchain’s potential far beyond simple transactions. These oracles enable a plethora of advanced financial applications, including lending and borrowing, algorithmic stablecoins, synthetic assets, and a variety of on-chain financial instruments such as derivatives, options, and futures.

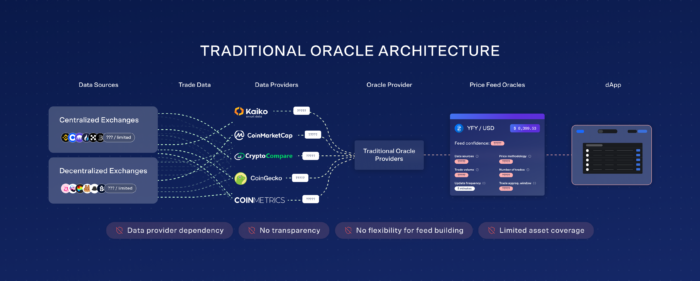

However, the current landscape of oracle providers is predominantly centered around third-party architecture. This approach involves leveraging external premium data providers and their APIs to feed price information onto the blockchain as oracles via a network of nodes. While functional, this model is fraught with challenges and limitations, particularly in its capacity to adapt and evolve with the diverse and dynamic needs of the blockchain and DeFi space.

Challenges

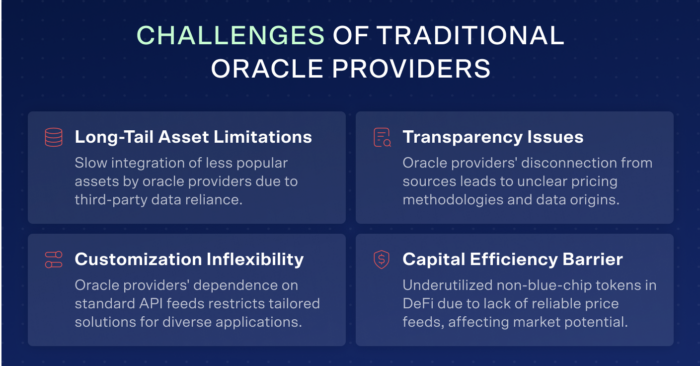

Limited scope for long-tail assets

The dependency on third-party data providers means that current oracle providers are often slow to adapt and unable to create oracles for less popular, long-tail assets. This restriction is due to a reliance on these external data sources, which typically focus on historically popular assets and established blue-chip tokens. As a result, a vast array of potentially valuable assets remains untapped and underutilized.

Lack of transparency and certainty

Another significant issue is the opaqueness surrounding data sources and pricing methodologies. Traditional oracle providers, being disconnected from the actual data source, are often unable to provide transparency regarding where and how the data is sourced and processed. This lack of clarity leaves data users in the dark, unable to fully assess the robustness and vulnerability of the price feeds.

Inflexibility in oracle customization

The current architecture of oracle providers primarily involves repackaging and relaying API feeds from data providers. This method severely limits the capacity to offer tailored oracles or modify the feed construction to meet specific needs. Consequently, this one-size-fits-all approach fails to address the unique requirements of various decentralized applications and use cases. For instance, dApps dependent on traditional oracles lack transparency and control over their feed’s actual data sources and cannot adjust them when market conditions change drastically.

The barrier to capital efficiency in utilizing non-blue-chip tokens

The underutilization of non-blue-chip tokens in dApps represents a significant inefficiency in capital utilization within the crypto ecosystem. The absence of available and reliable price feeds for these assets means that a vast market potential, estimated to be around 500 billion USD, remains largely untapped. Holders of these non-blue-chip assets face a stark reality: their holdings are not fully leveraged in DeFi.

Solution

In this article, we will examine how Silo, a non-custodial lending protocol, benefits from integrating and utilizing DIA’s price oracles for a series of non-blue-chip tokens, enabling the launch of lending markets for these assets. Unlike traditional methods that rely on pre-aggregated data from third-party providers, DIA adopted a more direct and innovative approach.

Direct Data Fetching

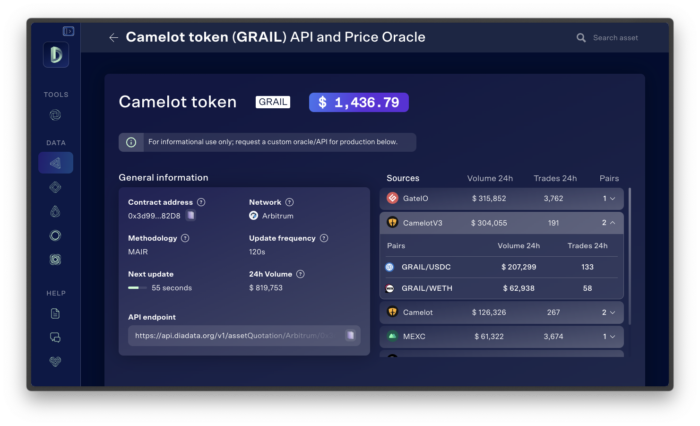

DIA’s architecture involves directly fetching trade data from 80+ centralized and decentralized exchanges. This granular approach captures every transaction for any asset pair across multiple exchanges. For instance, with the GRAIL token, data from various asset pairs such as GRAIL/USDC and GRAIL/WETH among others is gathered across multiple exchanges such as Camelot, Uniswap or Gate.io. As a result, DIA collects more than 5,000 trades across 6 exchanges, providing full transparency throughout the entire process.

Tailored Data Processing

Once collected, this trade data undergoes a validation and storage process. In collaboration with the Silo team, DIA applied tailored outlier filters and pricing methodologies, defining a unique methodology for each asset. This bespoke approach considers numerous factors such as each asset’s market volume, liquidity, number and frequency of trades, and the number of exchanges the asset is traded on. The detailed methodologies for each asset requested by Silo Finance are documented in the DIA Forum under the Silo CDR.

Responsive Suggestions and Adaptation

DIA not only catered to Silo’s needs but also took the initiative in offering improvements. For instance, in the case of the GRAIL token, DIA recommended and subsequently integrated a new centralized exchange, where the token is actively traded, as an additional source for their data feed. Adding a CEX brought a higher frequency of ticks to base the feed on, therefore improving the feed’s refresh rate. This approach of continuously incorporating new data sources and refining existing feeds demonstrates DIA’s dedication to delivering highly reliable and precise information.

Implementation

Dedicated Oracle Deployment

After finalizing the details with the Silo team, DIA deployed dedicated oracle smart contracts containing the requested price feeds, ensuring that each feed met the specific needs of Silo’s protocol. The oracle was swiftly integrated into the Silo protocol and enabled the launch of the leading markets Grail, Jones, Plutus, Silo and Y2K.

Agile Adaptation to Market Changes

In October 2023, anticipating the shift in the DEX scene due to the Arbitrum token grant distribution, DIA acted with foresight. Recognizing the impending liquidity migration for the token rDPX, included in the oracle, from Sushiswap to Camelot V3, DIA integrated Camelot V3 into its platform as a new data source. This quick adaptation allowed for immediate trade data collection for the rDPX asset as soon as the liquidity migrated, ensuring the continuity and stability of the price feed amid market changes.

Flexibility and Transparency

DIA’s approach is characterized by its flexibility and transparency, working closely with requesting teams to ensure clarity in the integration process, implications, and resilience of the feeds. Teams have the flexibility to add or remove sources, change the update frequency of the oracles, alter the pricing methodology, and much more, at any time.

DIA’s criteria for feed creation emphasize capturing significant liquidity (over $2 million) across at least two trading sources, with each source having a minimum liquidity of $500,000. If these criteria are not met, DIA does not recommend using the dApps in production environments due to the risk of manipulation.

Continuous Monitoring and Accessibility

Finally, DIA offers monitoring tools and interfaces to track real-time trading volume changes across the asset pairs and exchanges that are leveraged to create any price feed. The DIA App, freely accessible to all, allows users to view the current trade data captured by DIA’s integrated data sources, fostering transparency and user engagement.

Results

Successful Launch of Diverse Lending Markets

The integration of DIA’s oracles with Silo Finance led to the successful launch and operation of various lending and borrowing markets for several unique assets. The total value locked (TVL) in these markets is a testament to the effectiveness of this integration. Notably, at the time of writing (December 2023):

| Token | TVL | Market |

|---|---|---|

| Grail | 1.35 m USD | Grail | Silo |

| Jones | 993.86k USD | Jones | Silo |

| Plutus | $213.89k USD | Plutus | Silo App |

| Y2K | $181.48K USD | Y2K | Silo App |

| Silo | $1.95 m USD | Silo | Silo App |

These figures underscore the market’s positive reception and the trust users place in the reliability and accuracy of the price feeds powered by DIA oracles.

Rapid Integration of SILO Token

A significant milestone was the creation of a price oracle for $SILO, the governance token of Silo Finance, which led to the launch of a lending market for the same token within just 290 days of its inception. DIA’s ability to provide accurate and robust price feeds for a relatively new asset like $SILO demonstrates its capacity to support emerging tokens and adapt to the market’s evolving needs. Combining full data transparency with battle-tested methodologies is essential for creating certainty on the reliability of a price feed. This is crucial for the integration of new tokens like $SILO in DeFi applications.

Maintaining Market Resilience and Security

Silo Finance’s proactive approach, supported by DIA’s adaptable and responsive oracle services, ensured the protocol stayed ahead of market changes. An exemplary instance of this was Silo’s preparedness for liquidity shifts between decentralized exchanges. DIA’s quick deployment turnaround and ability to add new data sources on demand played a pivotal role in maintaining the integrity and security of Silo’s lending markets. This adaptability was crucial in responding to dynamic market conditions while ensuring uninterrupted and secure operations.

Overall Impact

The results of this collaboration highlight DIA’s pivotal role in enhancing Silo Finance’s operational capabilities. By providing tailored, reliable, and swiftly adaptable oracle services, DIA not only facilitated the expansion of Silo’s asset offerings but also bolstered the overall trust and security within their platform.

“We are on a mission to deploy isolated lending markets for all crypto assets. The integration with DIA opens doors for new possibilities, starting with the JONES lending market. We’re excited about the collaboration and looking forward to many DIA-supported lending markets.”Aiham JaabariSilo Finance Growth Lead

Request a Custom Oracle!

Ready to Propel Your dApp with Transparent Price Oracles?

Discover how DIA’s innovative approach to long-tail asset price feeds can transform your decentralized application. Offering unparalleled transparency and customization. Connect with us on Telegram now, where our experts are ready to guide you through the process of setting up a custom oracle.