2022 in Review: Data Source Integrations

Through 2022, DIA focused efforts on improving its product stack by integrating 40 new data sources for its platform, resulting in an increase in asset support and better oracle resilience to attack vectors.

An End-to-End Data Journey

DIA does it differently in the blockchain oracle landscape. Instead of distributing pre-calculated data feeds, DIA covers the whole data journey from granular data sourcing, price calculation, to the final oracle delivery. This end-to-end approach enables DIA to build fully customizable and transparent oracle services for its users.

For example, to develop an ETH/USD price feed oracle, DIA sources, filters and processes trade data of dozens of ETH pairs happening across many centralised and decentralised exchanges.

Continuous Product Stack Development

As an oracle provider, key for the development of Web3, DIA continuously focuses efforts on improving its product stack. Currently, the main targets are: 1) adding support for more assets and 2) making the oracles more resilient to malicious attack vectors.

Support for 3k+ Tokens Across 30 Blockchains

Being able to source trades directly from multiple markets in many ecosystems, avoids DIA to be limited in the breadth of data it can source and provide. Currently, DIA offers price feeds for 3k+ digital assets, operating across 30 blockchains including Ethereum, Solana, Fantom, Moonbeam, Astar and more.

Price Oracles Resilient to Market Attacks

One of blockchain oracle’s biggest risks and points of failure is not having enough sources and using a feed that relies on a single market. DIA’s multi-source approach currently enables the creation of price feed oracles with data coming from more than 60 sources, reducing exposure to middleman attacks.

Market Integrations by Type and Chain

Here is a list of the latest centralised and decentralised markets DIA integrated during the last 6 months, filtered by blockchain ecosystem:

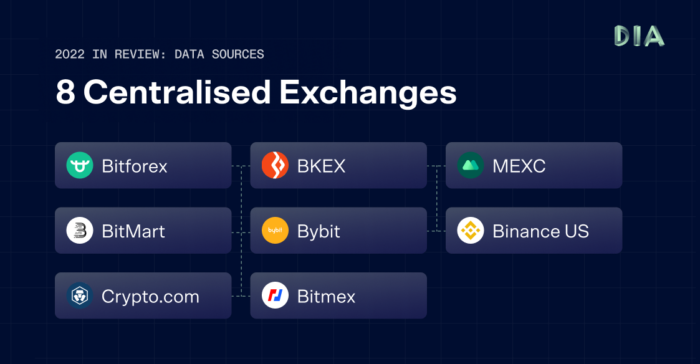

Centralized Exchanges (CEXs)

Crypto.com

Crypto.com is a centralised exchange, trusted by more than 70M customers worldwide and is boasted to be the world’s fastest-growing crypto app. DIA integrated Crypto.com to fetch real-time trade data for 115+ crypto assets.

Bitmex

Bitmex is a cryptocurrency exchange that offers margin trading and futures trading on a range of cryptocurrencies. It was founded in 2014 and is headquartered in Hong Kong. Bitmex was added to the list of data sources for the DIA Platform in 2022, fetching trade data for 31 assets.

MEXC Global

MEXC Global is a crypto asset exchange with up to 200x leverage across futures contracts and 1,500+ crypto assets available. The MEXC Global exchange scraper is live, and DIA is recording market data for over 75 asset pairs.

BitMart

BitMart Exchange is a one-stop platform to initiate your cryptocurrency investment and management. DIA pulls and aggregates trade data for over 50 high-quality currencies and 75+ trading pairs.

BKEX

BKEX Global offers a range of features, including spot trading, margin trading, and futures trading. The BKEX scraper is live, allowing DIA to fetch granular market data for 66 asset pairs.

ByBit

Bybit is a cryptocurrency exchange established in March 2018 to offer a professional platform where crypto traders can find an ultra-fast matching engine. The ByBit scraper is live, allowing DIA to fetch trade data of over 100 asset pairs.

BitForex

Bitforex is an exchange providing a wide range of trading tools including token trading, margin trading, and derivatives. Until October 2021, BitForex serves over 5 million users . DIA is scraping trade data from Bitforex for over 50 asset pairs.

Binance US

Binance.US is the U.S. registered arm of the world’s largest cryptocurrency exchange by trading volume — Binance. The separate exchange was launched in response to U.S. regulations restricting the main exchange. DIA is fetching market data for 150+ asset pairs in Binance US.

Decentralized Exchanges (DEXs)

Avalanche

Platypus

Platypus is an open liquidity single-sided AMM managing risk autonomously based on the coverage ratio, allowing maximal capital efficiency. The Platypus exchange scraper went live in 2022, fetching an average of over $6million in volume among 25 crypto pairs.

TraderJoe

TraderJoe is the leading decentralised exchange on Avalanche. DIA deployed a exchange scraper to fetch trade data from the DEX on Avalanche to build price oracles.

Pangolin

Pangolin is a multichain decentralized digital assets exchange DEX on Avalanche with 3200+ crypto asset pairs. The Pangolin exchange scraper is live, enabling DIA to fetch trade data from the DEX on Avalanche.

Metis

Hermes

Hermes is a decentralised exchange operating on the Metis Andromeda network. The Hermes scraper is now live, enabling DIA to fetch market data for 149 pairs of crypto assets.

Tethys Finance

Tethys Finance is the one-stop decentralized platform to fulfil all kinds of trading needs with the speed of Metis network. DIA is sourcing Tethys’ trade volume that exceeds $1billion among 1450+ trading pairs.

Netswap

Netswap is a decentralized exchange and uses the same automated market-making (AMM) model as Uniswap. DIA is fetching market data for over 1000 asset pairs on Netswap.

Fantom

Spiritswap

SpiritSwap captures the essence of everything Defi 2.0 on the Fantom network, delivering a complete hub for trading between 2270 pairs, lending and borrowing crypto assets, reward sharing, staking delegations, and farming. Spiritswap is now a data source for DIA.

Curve Finance on Fantom

Curve is a multi-chain DEX built with an automated market maker architecture, optimizing the swapping of digital assets with identical pegs. DIA integrated with Curve on Fantom to source real-time market data for 130+ asset pairs.

SpookySwap

SpookySwap is an all-in-one decentralized exchange for leveraging diversified funds across ecosystems, with the speed of Fantom Opera. SpookySwap is now a new data source, enabling DIA to fetch 1000+ Fantom-native assets.

Polygon

Balancer V2 on Polygon

Balancer V2 is a decentralized protocol with the mission is to accelerate innovation in DeFi by providing access to secure infrastructure for liquidity applications. The Balancer V2 scraper went live this year enabling the market data fetching of 2500+ asset pairs.

Uniswap V3 on Polygon

The Uniswap Protocol is an open-source protocol for providing liquidity and trading tokens on multiple chains. DIA is fetching market data in real time for 6187 asset pairs on Polygon.

Quickswap

Quickswap is a DEX designed to offer fast, cheap, and secure trading of cryptocurrency pairs through its liquidity pool model. With over $ 167 million in TVL, DIA is fetching live trading data for thousand of assets on the Polygon network.

DFYN

DFYN is designed to offer a simple and user-friendly interface that allows users to easily provide liquidity and earn yield from a variety of different assets.. DIA integrated the protocol to aggregate market data for 1668 crypto pairs on Polygon.

Curve Finance on Polygon

Curve is a multi-chain DEX built with an automated market maker architecture, optimizing the swapping of digital assets with identical pegs. DIA integrated with Curve on Polygon to source real time market data for 300+ asset pairs.

Moonbeam

Stellaswap

Stellaswap is one of the first automated market-making (AMM), decentralized exchanges for the Moonbeam parachain network. StellSwap is now a new data source for DIA, enabling DIA to build price feed oracles for 343 Moonbeam-native assets

Curve Finance on Moonbeam

Curve is a multi-chain DEX built with an automated market maker architecture, optimizing the swapping of digital assets with identical pegs. DIA integrated with Curve on Moonbeam to source real time market data for 18 asset pairs.

Moonriver

Solarbeam

Solarbeam is a decentralized exchange, providing liquidity and enabling peer-to-peer transactions on the Moonriver Network. DIA is currently scraping live trading data for 641 asset pairs on the exchange.

Huckleberry

Huckleberry is a community-driven AMM cross-chain DEX and lending platform built on Moonriver and CLV. DIA sources market data from 110 crypto asset pairs on Moonriver to build customizable price oracles.

BNB Chain

Biswap

Biswap is a trading DEX that boasts the lowest trade fee of 2% in the DeFi space and an exchange fee reimbursement of up to 50%. The BiswapDEX scraper is now live, enabling DIA to source market for 2300+ asset pairs on the BNB Chain.

Apeswap

Apeswap is a multichain DeFi Hub that offers an accessible, transparent, and secure experience for everyone on the Binance Smart Chain. The ApeSwap scraper is live, enabling DIA to source every trade information for 4000+ asset pairs from the BNB Chain.

Astar Network

ArthSwap

ArthSwap is a one-stop DeFi protocol that aspires to be the main DEX on the Astar Network. Its primary products are decentralised asset swap, IDO launchpad, and liquidity farming. ArthSwap was added as a new data source enabling DIA the fetch trade data for 250+ asset pairs.

Celo

Ubeswap

Ubeswap is a mobile-first DeFi AMM exchange on Celo. Ubeswap allows users to buy and sell cryptocurrency and deposit LP tokens in staking pools to earn yield. The Ubeswap scraper is live, and enables DIA to source market data for 700 asset pairs from the DEX.

Evmos

Diffusion

Diffusion is the DEX powering liquidity for the Cosmos EVM. The AMM protocol is designed for efficient trading between 380 pairs of crypto-assets. The live scraper allows DIA to fetch market data from the DEX.

Telos

OmniDex

OmniDex is an automated market-making decentralized exchange built on the Telos EVM. With OmniDex, you can swap, farm and earn rewards. The Omnidex scraper is live, meaning that DIA collects and aggregates market data from the DEX.

Ethereum

Balancer V2

Balancer V2 is a decentralized protocol with the mission is to accelerate innovation in DeFi by providing access to secure infrastructure for liquidity applications. The Balancer V2 scraper went live this year enabling the market data fetching of 1000+ asset pairs.

Arbitrum

Uniswap V3 on Arbitrum

Uniswap is one of the leading decentralized crypto trading protocols. You can earn, swap and build on the platform with over $1trillion in trade volume and over 123 million total trades among 132,000+ available trading pairs. The Uniswap V3 exchange scraper is now live on the Arbritrum network, enabling DIA to source market data from the DEX.

Wanchain

Wanswap

Wanswap is a decentralized exchange with automated market-making (AMM) modelled after Uniswap & Sushiswap. DIA now fetches price data for 150 asset pairs from the Wanswap DEX built on the Wanchain network.

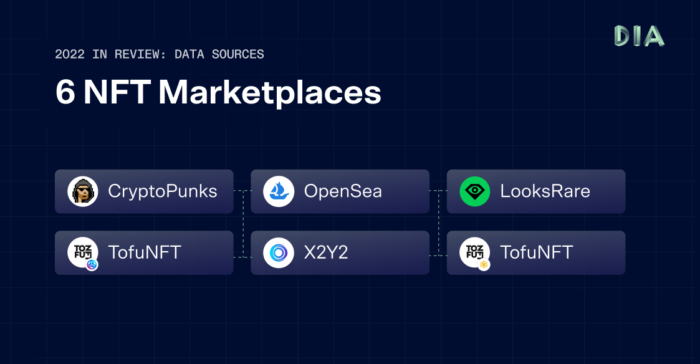

NFT Marketplaces

OpenSea

OpenSea is the first and largest Web3 marketplace for NFTs and crypto collectibles. Over 2 million users use OpenSea to browse and trade the thousands of NFT collections available on OpenSea. DIA now sources NFT trade data from OpenSea.

X2Y2

X2Y2 is a decentralized NFT marketplace on Ethereum run by the people, for the people. 100% of generated revenue is shared with X2Y2 token stakers. The X2Y2 exchange scraper is now live, enabling DIA to fetch NFT trade data from the marketplace on Ethereum to build NFT floor price oracles.

LooksRare

LooksRare is the community-first NFT marketplace on Ethereum that actively rewards traders, collectors and creators for participating. Traders and collectors on Looksrare have earned over $1.3 Billion in rewards. The LooksRare exchange scraper is now live, enabling DIA to fetch NFT trade data from the marketplace on Ethereum to build NFT floor price oracles.

TofuNFT on BNB Chain

TofuNFT is a multichain NFT marketplace live on the Binance Smart Chain and 30+ EVM-compatible public chains, focused on GameFi. DIA now sources NFT trade data from TofuNFT on the BNB Chain.

Deactivated Scrapers

Due to FTX crash in Novemeber 8, 2022, many projects were affected, including FTX exchange itself and other related projects in the Solana ecosystem. Some of those exchanged were integrated into the DIA Platfrom earlier in the year. But due to safety concerns, FTX, Serum and Raydium were temporarily removed as a data source for the DIA Platform, stopping all trade collections from the CEX. FTX trades did not have any negative impact on the price estimations of any asset’s price feed. DIA’s price quotation engine handled the volatile market situation smoothly.