Intro

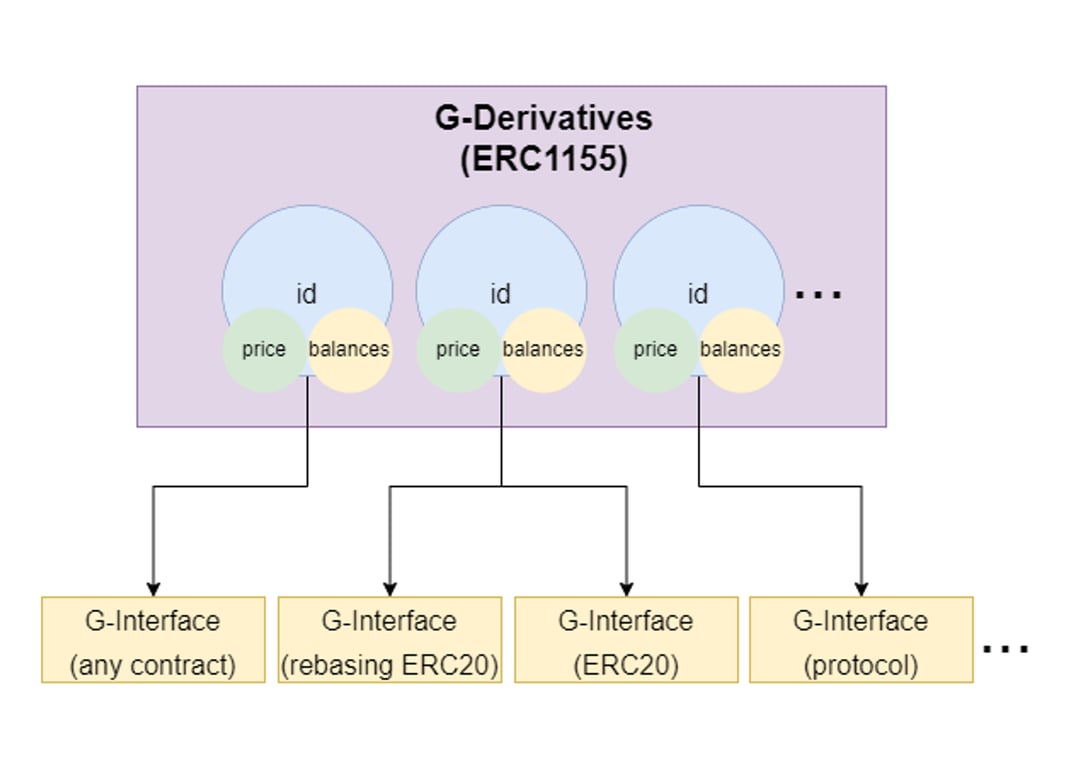

The gAVAX token is an immutable ERC-1155 contract, that are utilized for internal accounting within Geode's staking library.

When you stake in a liquid staking derivative product powered by Geode, you mint a G-Derivative. This is either gETH or gAVAX, depending on the blockchain being used. The gETH or gAVAX minted is actually the corresponding LSD for the selected staking pool.

Overview

By using a single ERC115 contract, it allows Geode’s infrastructure to provide for a wide array of different staking product types, as well as allowing for better compatibility in the future. Put another way, G-Derivatives are databases of Balances and Prices with extra Scalability (interfaces).

The key benefit with Geode’s G-Derivatives are their highly configurable nature. For example, via Geode’s interfaces pool owners may choose whether they want their LSD to function as a value accrual or rebasing token.

NOTE: Although broadly similar as G-Derivatives, there are some key differences to understand between gAVAX and gETH. For a breakdown in the differences between the two, click here.

Want to add new integrations or edit this page? Submit this FORM.

Issuer

Integrations

yyAVAX

yyAVAX is Yield Yak’s liquid staking derivative token which represents AVAX staked or delegated in validators. yyAVAX is a yield-bearing token and has a monotonic function, meaning its price increases over time to reflect the yield it is generating.

NOTE: Currently yyAVAX is the only liquid staking token utilizing Geode’s infrastructure on Avalanche. Users can simply stake AVAX for yyAVAX, and passively earn from validator rewards.

Explore apps and services using gAVAX:

gAVAX integrations

Table view

dApp

Use case

Link

LSD Utility

Details

This is a LIVE document, continuously updated by the protocol teams, communities and contributors. Note that the information in this Notion board might be outdated or wrong. The contributors are not liable for any incorrect or incomplete information within this Notion board.