Features

- Independent of market volatility or liquidity distortions.

- Transparent methodology based on verifiable reserves, liabilities, and contract logic.

- Applicable across DeFi instruments ranging from liquid staking tokens to stablecoins and vaults.

Methodologies

Contract Exchange Rate

For tokens with built-in exchange logic (e.g. stETH, aUSDC, cDAI), price is calculated from the ratio of underlying assets to total shares:Reserve-Backing

For collateral-backed assets, reserves are divided by circulating supply to produce a backing-based fundamental value: Reserves may consist of multiple assets held across wallets.Net Asset Value (NAV)

For vault-based tokens, price equals the value of assets minus liabilities, divided by outstanding tokens:Redemption Value

For mint/burn models, the fundamental value corresponds to the amount of underlying assets received when redeeming one token. This is typically retrievable directly from the redemption contract.Proof of Reserves

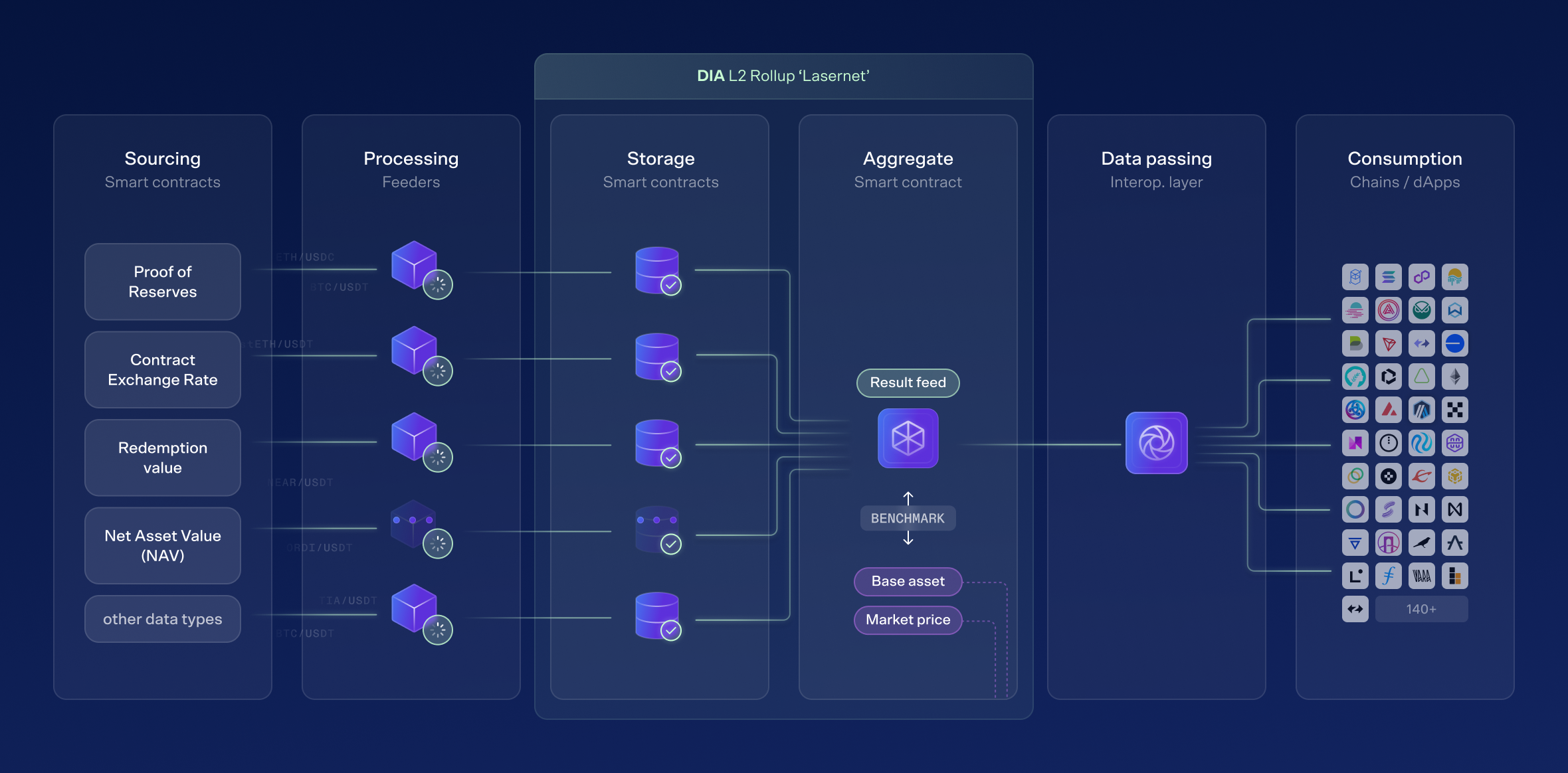

For custodial or synthetic assets, feeds can publish the total value of reserves as reported by verified custodians or proof-of-reserve attestations:Architecture Flow Overview

- Each feeder is pulling balance sheets (reserves, supply).

- Lasernet is the ledger where all feeders submit their reports.

- The aggregator contract is consolidating those reports into one official number.

- The messaging layer is delivering that number to every chain where it’s needed.

- Protocols then rely on this official number to decide risk and operations.

Use Cases

- Stablecoins: Validate peg integrity by comparing market price to backing-based fundamental value.

- Yield-bearing Tokens (LSTs, aTokens, cTokens): Track accruing value through exchange rates.

- Vaults and Structured Products: Monitor NAV in real time to ensure accurate token pricing.

- Synthetic Assets: Ensure collateralization ratios remain healthy through reserve-backed valuations.

Developer Notes

Fundamental Feeds can operate alongside traditional market price feeds. Protocols can consume both sources to implement safeguards such as:- Depeg monitoring (triggering alerts if fundamental value diverges from market price).

- Fallback mechanisms to fundamental pricing when market feeds become unreliable.

- Enhanced transparency by exposing raw inputs such as reserve addresses or contract state.